Focused Investment Strategies from Harvest

Bespoke Investment Portfolios

Our Tailored Investment Strategies provide additional investment options for investors who wish to focus a portion of their overall fund in certain themed investments.

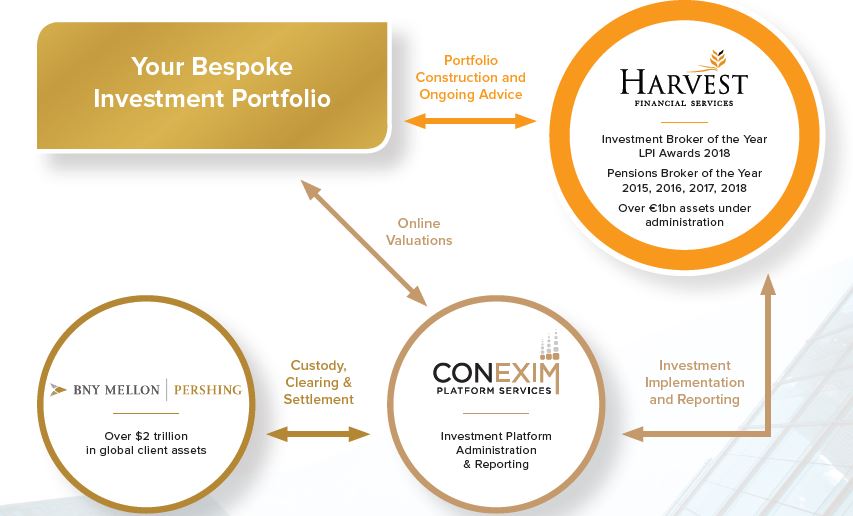

Providing you with personalised investment advice and dedicated support, Harvest’s Investment Advisory Service delivers bespoke investment solutions based on a foundation of sound financial planning.

Through the Conexim Investment Platform we offer our clients access to Pershing Securities International Ltd and a range of Tailored Investment Strategies constructed from an investment universe of thousands of funds.

Each strategy is designed to take advantage of thematic long term investment trends and can be structured as a standalone investment or incorporated within larger portfolios.

Cash Alternative Strategy

The Cash Alternative Strategy aims to deliver a return over the medium term significantly above the rate paid on cash deposits, while delivering a low level of volatility.

The Cash Alternative Strategy may be of particular interest to you if :

• you want a positive return in excess of cash deposits in the medium term.

• you are looking for alternatives to holding long-term cash in their portfolios.

• you want a regular income distribution from their investment

ESG Strategy

The ESG Strategy comprises four liquid funds, two equity based funds, one ethical bond fund and a specialised solar energy investment trust. The overall strategy therefore offers a broad asset mix.

The ESG Strategy may be of particular interest to you if:

• you wish to invest in diversified funds that satisfy your principles as well as your financial needs.

• you want to generate long-term competitive financial returns and mitigate downside risk, as well as having a positive impact on society.

• you want to make your money matter.

Income Strategy

The Income Strategy aims to generate income via four funds providing daily liquidity, a global spread and exposure to a range of asset classes. These asset classes do not have a strong correlation during the investment cycle.

The Income Strategy may be of particular interest to you if:

• you want an income focus included in your portfolio.

• you want to match your post retirement draw down with income.

• you have concerns around future volatility in investment markets.

Liquid Property Strategy

The Liquid Property Strategy offers investors an alternative to direct property investment. The strategy combines the ability to trade freely with a reliable stream of income.

The Liquid Property Strategy may be of particular interest to you if:

• you want to maintain your exposure to property within a diversified portfolio.

• you don’t want the responsibly of maintaining a direct property portfolio

• you want a regular income distribution from your property allocation.

• you value the flexibility that comes with Daily Liquidity.

Future Tech Strategy

The Future Tech Strategy aims to gain exposure to themes which are expected to deliver strong growth across the globe over the coming decade. These include Biotechnology, Blockchain and Robotics.

The Future Tech Strategy may be of particular interest to you if:

• you have long time horizons in relation to your pension and savings plans.

• you are happy to take a small exposure to emerging sectors which could potentially deliver strong growth.

• you do not require an income from these investments

Harvest Wealth Management

This marketing information has been provided for discussion purposes only. It is not advice, it is

provided for general information purposes only and does not fully take into account your financial

position, investment needs and objectives, attitude to risk, liquidity needs, capital security needs,

capacity for loss, etc. It should therefore not be relied upon to make investment decisions. Prior to any formal investments taking place you will be provided with a detailed suitability letter taking into account all the above and outlining why the investment(s) are (not) suitable for you.

Warnings: The figures refer to the past. Past performance is not a reliable indicator of future results.

The value of investment(s) in the selected fund(s) may go down as well as up. If you invest in the

selected fund(s) you may lose some or all of the money you invest. Past performance is not a reliable

guide to future performance. Income may fluctuate in accordance with market conditions & taxation

arrangements. The income you get from this investment may go down as well as up. The return may

increase or decrease as a result of currency fluctuations.