ARF or Annuity – which option might suit you best?

ARF or Annuity – which option might suit you best?

The right choice depends on a lot of things and will be very specific to your personal circumstances.

As the annuity option is irreversible it is important to get a clear view of all the retirement options available to you to ensure that you get the best outcome, for you and for your family.

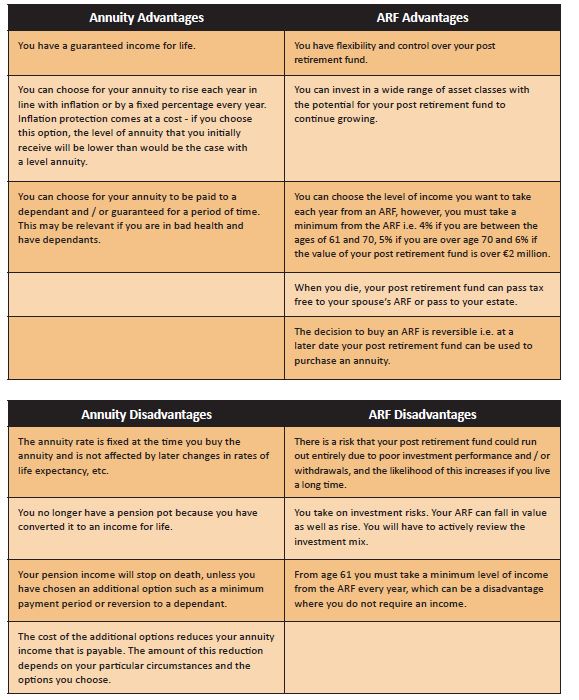

Some of the advantages and disadvantages to consider about annuities and ARFs are:

If, having reviewed your options, you decide that an annuity is the best option for you, your Harvest advisor will review all options available in the market to find the most suitable annuity for you.

If you decide that the ARF option is for you, how do you choose the most suitable ARF for your own personal circumstances?

Sourcing a sustainable retirement income is a huge challenge, but you also have more options than ever before to help you find a solution. As a starting point your Harvest advisor will help you answer the following questions:

- What is the value of my pension pot at retirement?

- What are my other sources of retirement income likely to be worth e.g. the State Pension, income from property and other personal savings and investments, etc.?

- How long will my pension pot at retirement need to last?

- How much income will I require to meet my needs in retirement?

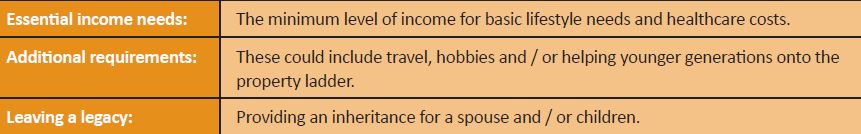

For many people, retirement now represents an opportunity to realise life-long ambitions, pursue new passions and / or help family members with their financial needs. This is why we in Harvest think it is important to make a distinction between essential income needs and additional requirements.

What is your next step?

There is no easy answer or ‘one-size-fits-all’ solution, so it is important to understand all the options. Each option has its pros and cons. You do not have to choose just one option and you may find that a ‘mix and match’ approach is the most appropriate for your situation. Your Harvest advisor will guide you through the options, considerations and challenges ahead so you can understand the choices you need to make at the point of retirement and throughout the years ahead.

Contact us on 01 2375500 or at justask@harvestfinancial.ie to arrange an initial meeting with one of our advisors. At this meeting we will seek to find out what your needs and objectives are in retirement and we will set out how we would work together to secure the lifestyle you wish to enjoy in retirement.

After you have made adequate provision for your essential income needs, you may want to ask yourself another question with the aim of meeting your additional requirements: Can I afford to take risk with some of my post retirement fund to aim for better returns?

Warnings: If you purchase an annuity you will not have any access to the money you set aside for retirement. If you set up and ARF you may lose some or all the money you set aside for retirement. Income may fluctuate in accordance with market conditions and taxation arrangements. Past performance is not a reliable guide to future performance.

The material is not intended to provide advice and is provided for general information purposes only. It should not be relied on to make decisions on retirement options.

The legislative information contained herein is based on Harvest Financial Services Limited’s understanding of current practice as at June 2017 and my change in the future.

Please note that the provision of this product or service does not require licensing, authorisation or registration with the Central Bank and, as a result, it is not covered by the Central Bank’s requirements designed to protect consumers or by a statutory compensation scheme.