ESG Strategy

The ESG Universe

ESG fund managers seek to address these issues through active management, negative screening and collaboration with companies as shareholders.

The ESG acronym stands for Environmental, Social and Governance. While most casual observers may be under the impression that the phenomenon of ESG is very recent in the world of investing, the fact is that it has been around in one form or another for more than 50 years.

However, back then investment thinking was dominated by the philosophy of economists such as Milton Friedman who argued that ‘ companies’ only social responsibility is to maximise shareholder value’ i.e. to simply focus on enhancing value for holders of the

stock and to discount everything else.

While this thinking did dominate there was a small but growing segment of the investment market who were focused on Socially Responsible Investing (SRI) and their thinking was influenced at the time by a number of issues including the nuclear arms race, tobacco and the apartheid regime in South Africa.

Why ESG?

Shifting to the mainstream

The world of ESG has come along way in the past thirty years and is now arguably part of the investment mainstream as opposed to being a peripheral investment theme. More and more, the markets expect companies to demonstrate their ESG credentials and show where they stand in relation to the key ESG issues.

As measurement and analytics become more sophisticated and in-depth, ESG Indices are also becoming more accurate and more accepted by the investment community. Following on from this, institutions are already ascribing ESG scores to all companies they analyse based on a number of key criteria.

Government and Institutional Support

While Governments have given tacit support to these issues for quite some time, particularly with regard to climate and the environment, the degree of serious commitment has clearly picked up over the past eighteen months. Christine Lagarde, the Head of the ECB, has put climate considerations at the heart of any future support plans for markets and economies.

In addition, European financial regulators have built ESG factors into their assessment and regulation of banks and other financial institutions. Even in emerging markets, Governments are beginning to recognise the importance of these issues and are giving increasing support to ESG programmes, both financial and regulatory.

Investor Demand

As awareness about climate change and a whole range of social issues has grown in recent years, there is demand from the general population that the companies they invest in via their pension funds or savings products measure up in ESG terms.

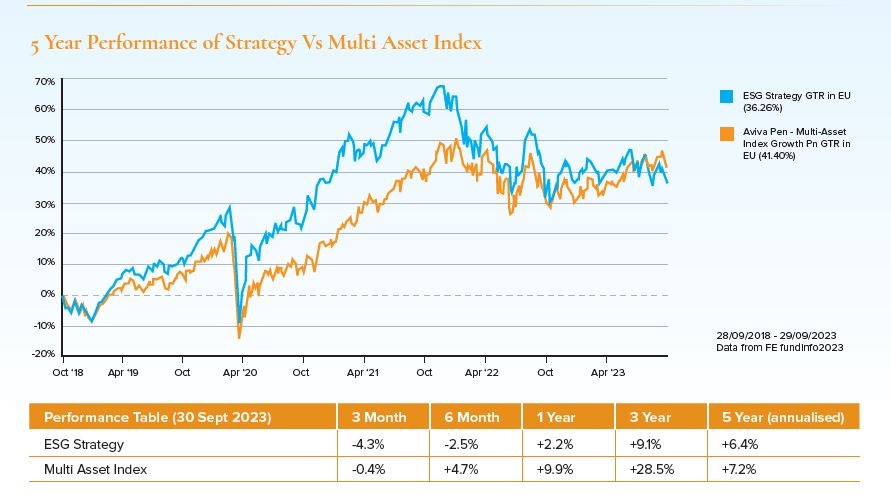

In fact, repeated surveys have shown that the majority of millennials would be willing to sacrifice some return on their investments in exchange for an ESG investment focus. However, as the chart shows (Harvest ESG Strategy vs. a standard multi asset portfolio index) ESG has tended to outperform rather than lag.

Historic Performance of the Harvest ESG Strategy vs. Multi Asset Index over 5 Years

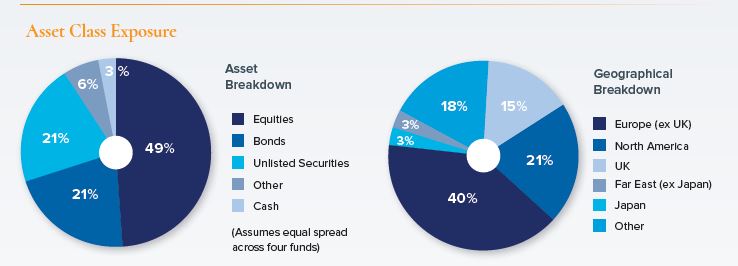

The Harvest ESG Strategy comprises four liquid funds, two equity based funds, one ethical bond fund and a specialised solar energy investment trust. The overall strategy therefore offers a broad asset mix.

There is a reasonably strong equities focus as might be expected but the addition of a bond and a solar fund bring elements of lower volatility and income respectively to the strategy. All four components deliver strong sustainability characteristics.

Source – Financial Express

Commentary on Recent Performance (September 2023)

Despite the increasing amounts of media attention being given to the topic of ESG currently, it has fallen somewhat out of favour with investors over the recent past. This has been reflected in the performance of the fund over the past quarter. However, given the global importance of this issue, and the projected growth rates likely to ensue for the sector, we remain confident of the longer term outlook for the strategy in terms of delivering relative outperformance for investors.

| As a company, we consider ESG funds critical to allow us to construct portfolios that satisfy our clients’ principles as well as their financial needs. It is our view that over time, this ESG strategy can generate long-term competitive financial returns and mitigate downside risk, as well as having a positive impact on society. |

Other Strategies from Harvest include:

Warning: The figures refer to the past. Past performance is not a reliable indicator of future results.The return may increase or decrease as a result of currency fluctuations

Warning: If you invest in this product you may lose some or all of the money you invest. The return may increase or decrease as a result of currency fluctuations. Income may fluctuate in accordance with market conditions and taxation arrangements. Changes in exchange rates may have an adverse effect on the value price or income of the product.

This marketing information has been provided for discussion purposes only. It is not advice, it is provided for general information purposes only and does not fully take into account your financial position, investment needs and objectives, attitude to risk, liquidity needs, capital security needs, capacity for loss, etc. It should therefore not be relied upon to make investment decisions. Prior to any formal investments taking place you will be provided with a detailed suitability letter taking into account all the above and outlining why the investment(s) are (not) suitable for you.