Investing in Times of Crisis

Crisis events, whether it be a personal crisis or a global event such as the one we are currently experiencing, tend to bring about in a shift in the way we view our financial affairs. For most of us, the natural instinctive reaction is to become more short term, more fearful and more conservative in our financial outlook.

It is a well recognised phenomenon in human psychology that our minds tend towards the assumption that when things are getting better they will continue to improve and when things are getting worse they can only worsen further.

It is this thinking which encourages retail investors to invest most heavily at the top of the market and to panic sell after a significant downward correction.

A relatively recent example of this was the surge of funds directed to Irish property in the 2005-07 period (much of it borrowed) and the subsequent panic in 2008 and afterwards as property prices fell. In the stock market this trend has been repeated again and again over the past 100 years. It is the same thinking which has created bubbles in asset values throughout history from tulip prices in the 1600s to the tech sector bubble in 2000.

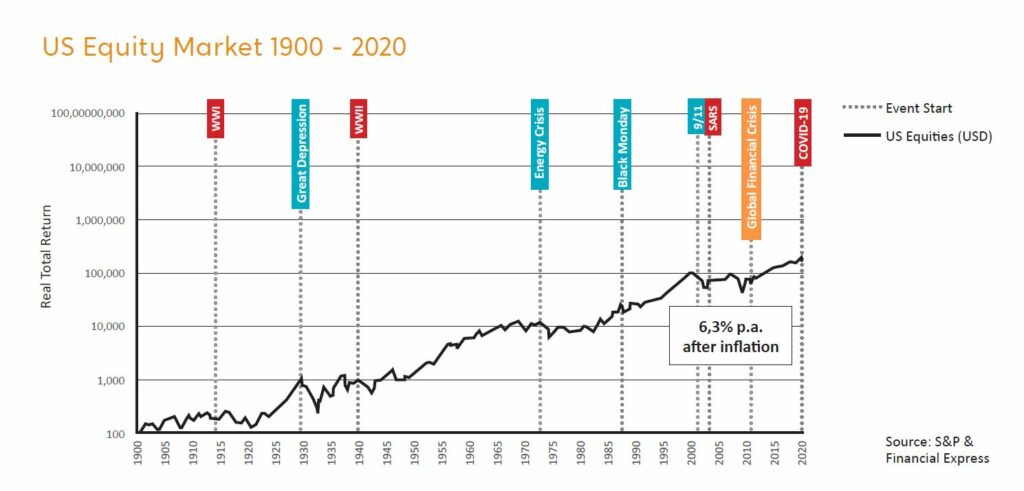

However, if history has taught us anything over the very long term, it is that equity and other asset prices move in cycles, which are, unfortunately, never predictable in duration but that over the long term, values will trend upwards.

While the instinct to panic during a financial crisis is to be resisted, a crisis can be a very good time to carry out a personal financial health check to ensure the important parts are in order. This exercise should not only prove useful but should assuage any feelings of fear or panic which have arisen as a result of the crisis.

To assist in doing this, it can be very instructive to ask yourself a series of high level questions and, ideally with the help of your adviser, to follow up on areas which may need adjustment or attention.

What are my Liquidity Requirements over the Medium Term?

Taking a conservative view of your life circumstances what cash needs are reasonably likely to arise over the medium term, and by medium term we really mean 2-3 years. Potential needs might include educational fees, contributing towards a house purchase, clearing a loan or simply providing for rainy day money.

If the liquidity query relates to a pension fund, then the planned retirement date is the critical time as liquidity will not be required in advance of that date.

Funds which may be needed for any such purposes over this kind of time frame should not be invested in higher risk assets such as equities and regardless of the very low interest rates currently available are best largely retained in cash.

Is my Investment Portfolio Appropriately Diversified across Asset Classes?

The most common issue arising here for Irish investors relates to property. Our longstanding love of property tends to result in many of us carrying an excessive exposure to this asset class, often in the form of a single investment property. Even the disastrous property market crash of 2008 did not result in an end to this love affair.

One of the major difficulties with property of course is its illiquidity which can really be thrown into sharp relief during periods of market weakness.

It is a strong likelihood that Irish property prices will emerge from this current crisis materially lower compared to where they were before the crisis and, compared to other more liquid asset classes, it may be quite a long time before they fully recover.

Does the Risk Profile of my Fund Match my own Risk Profile?

The follow on questions from this are firstly what is my risk profile and secondly, how should I determine it? One of the problems around risk profile is that while it should evolve over the longer term, it should not vary materially over shorter periods, unless there is a significant change in our life circumstances.

Unfortunately, the reality is that our attitude to risk tends to be substantially influenced by events such as the current crisis which can generate a skewed perspective in relation to risk.

In our view the two main factors to take into account when deciding on your risk disposition are (i) your time horizon – clearly the longer your time horizon the more risk you can afford to take on and (ii) your need to achieve growth in your funds – if you are very well provided for, you may not need to take on significant risk.

The message here is don’t expose your fund to risks you don’t need but don’t fail to take on a sufficient level of risk to ensure you meet your longer term goals.

Is the Crisis Presenting Opportunities?

When stock markets fall, it can often present opportunities and new investment during a crisis can often lead to very positive longer term outcomes. There are a couple of different approaches to taking advantage of such opportunities. Firstly one can simply make an investment into a well diversified global or regional equity fund.

This might be by way of either passive or actively managed funds. Secondly, one could take a thematic approach and invest in particular sectors or themes which might benefit relatively well as the world exits the current crisis. Examples of such sectors might include Healthcare, Food and Technology; and many commentators feel that the crisis will lead to even more emphasis being placed on ESG investments.

A crisis such as the one we are experiencing is an ideal time to re-examine your financial plan and to make adjustments to ensure that your portfolio is set up to meet your longer term investment goals, particularly as those goals may have shifted since last reviewed. We would strongly recommend a conversation with your financial adviser in Harvest as a first step in this very important process.

We’re here to help. If you have any queries on investing in times of crisis – or simply want to chat about your investment goals – contact us on 01 237 5500 / justask@harvestfinancial.ie

This marketing information has been provided for discussion purposes only. It is not advice, it is provided for general information purposes only and does not fully take into account your financial position, investment needs and objectives, attitude to risk, liquidity needs, capital security needs, capacity for loss etc. It should therefore not be relied upon to make investment decisions. Prior to any formal investments taking place you will be provided with a detailed suitability letter taking into account all the above and outlining why the investment(s) are (not) suitable for you.