Retirement Income

“You’re never too old to set another goal or dream a new dream.” C.S. Lewis

Working out how to make adequate financial provision for retirement is one of the most important financial decisions most of us will ever face. It can be a daunting topic and the options may seem overwhelming. However, making the right decision can make all the difference to the lifestyle that you enjoy in retirement. We hope this guide will remove some of the complexity around the considerations and challenges ahead, so you can understand the choices you need to make.

Flexible Retirement Options

Retirement used to be about ‘lump sums and annuities’ for most people. The money accumulating in your pension pot can be used to buy a regular income for life, after the lump sum has been taken. This regular income for life is called an annuity. However, growing concerns that some of these annuity products were offering poor value, and failing to cope with a changed retirement landscape, led to the Government introducing the ‘lump sum and Approved Retirement Fund’ (ARF) option to all members of Defined Contribution pension schemes.

How much of a lump sum can I take?

Depending on the type / terms of the pre retirement arrangement, you can draw a lump sum based on your salary and service to a maximum of 1.5 times final remuneration where you have more than 20 years service or you can take a lump sum based on 25% of the value of the pension pot.

A second limit of €500,000 then applies to the lump sum where the first €200,000 is tax free and the balance up to the €500,000 is taxable at 20%.

This lump sum may be invested to provide additional income in retirement.

What is an ARF?

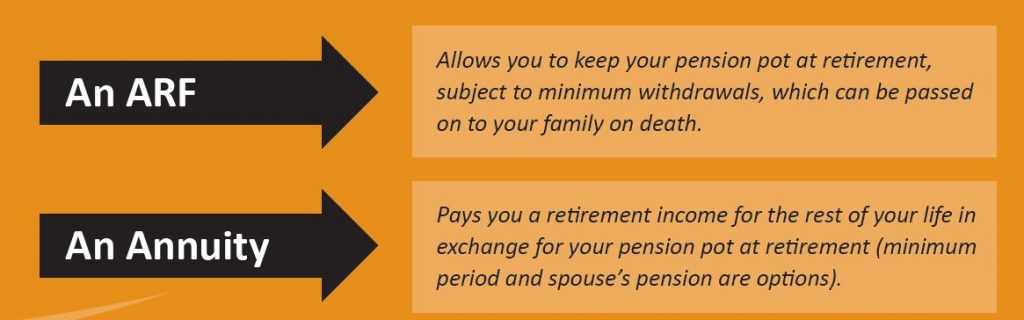

An ARF is a post retirement fund which allows you to keep your pension pot after retirement, withdraw an income and invest your ARF in different asset classes.

You can withdraw a retirement income from the ARF as required, subject to a minimum withdrawal each year once you are over age 60 for a whole tax year. On death any balance remaining in your ARF can pass tax free to your spouse’s ARF or is payable to your estate where it will be subject to applicable statutory deductions and / or inheritance tax.

What is an annuity?

Often referred to as a pension, an annuity provides a known stable income for the rest of your life. An annuity can be purchased from an insurance company in exchange for your pension pot at retirement.

ARF or Annuity – which option might suit you best?

Warnings: If you purchase an annuity you will not have any access to the money you set aside for retirement. If you set up and ARF you may lose some or all the money you set aside for retirement. Income may fluctuate in accordance with market conditions and taxation arrangements. Past performance is not a reliable guide to future performance.

The material is not intended to provide advice and is provided for general information purposes only. It should not be relied on to make decisions on retirement options.

The legislative information contained herein is based on Harvest Financial Services Limited’s understanding of current practice as at June 2017 and my change in the future.