Income Protection Insurance

Why Consider Income Protection now?

We are living in unprecedented times. Many professional and company directors have seen their income disappear or be significantly reduced since lockdown started. As the restrictions ease and businesses reopen the ability to earn income returns. But what if this loss of income happened again due to an illness or injury that prevented you from getting back to work? Could you replace your income long term?

Income Protection provides a replacement income if you cannot work due to illness or injury after a specified period of time. Whether you are Self-Employed, a PAYE employee or a Company Director you can take out Income Protection and receive tax relief on the premiums paid at your highest rate of tax.

Your income is likely your most important asset. At Harvest our advice to clients is to ensure they protect their most valuable asset.

The average period for an Income Protection claim is just under 6 years – would you be able to continue to meet your financial commitments if you were unable to work for that length of time?

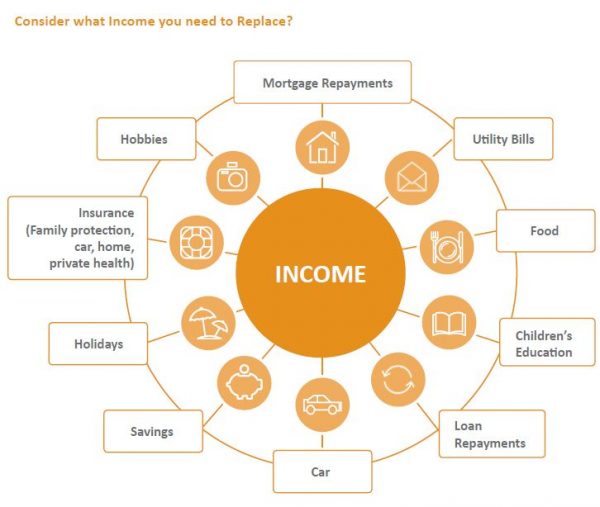

How much cover do you need?

With sufficient Income Protection in place your lifestyle won’t suffer if any accident or illness leaves you unable to work and earn an income. Instead, your Income Protection policy will pay you a replacement income of up to 75% of your normal income – enough to cover your most pressing financial needs while you recover. And the best bit? It’s eligible for tax relief at your marginal rate.

Your Harvest Advisor will help you determine how much cover you require, reflecting your income and any state entitlements you might be able to claim for.

In general terms, the maximum level of cover you can put in place is the lower of:

- 75% of your total annual earnings, less any state benefits for disability (excluding any children’s benefits)

- €250,000 a year

How does Tax Relief on Income Protection Work?

You can claim Tax Relief on premiums paid for Income Protection at your marginal (highest) rate of tax, up to a yearly limit of 10% of your total annual income. This can significantly lower the net cost of your Income Protection policy.

As an illustration of the impact the Tax Relief can have, the below indicative pricing is for a 30 year old insuring 75% of an €80,000 per annum salary, less the State disability benefit:

| Annual Salary | €80,000 |

| 75% | €60,000 |

| Less State Disability Benefit | (€10,296) |

| Annual Income Protection Benefit | €49,704 |

| Gross Monthly Premium | €56.49 |

| Cost after Tax Relief | €33.89 |

If you are a member of a group Income Protection scheme, your employer will usually pay your premiums from your salary before tax.

If you have an individual policy the insurance company will give you an annual statement showing the premiums paid. To claim your tax relief, you include this information on your tax return.

Who Needs Income Protection?

You may need Income Protection if you:

- Are Self-Employed and would have no source of income if you couldn’t work due to illness or disability.

- Have little or no sick pay from your employer.

- Have no ill health pension protection.

- Have dependents who rely on your income.

- Have no other source of income other than earned income.

- Do not have sufficient assets to replace lost income and cover ongoing expenses.

How do I learn more about Income Protection?

For more information, or to arrange a meeting discuss your particular income replacement requirements, contact Harvest on 01-2375500 or email us at justask@harvestfinancial.ie.

Business Protection

IMPORTANT POINTS ABOUT INCOME INSURANCE

If you stop making your regular payments, you will no longer be protected, and will not be refunded any money.

You can not cash in your plan – it is not a savings plan.

If is very important that you re-evaluate your plan benefits against your current earnings, as they my not continue to meet your current earnings, as they may not continue to meet your needs.

At the time of a claim, your earnings must be above the level that justifies the amount of cover you have chosen. If not, you will receive a reduced benefit. In this case, we will not refund any part of the payments you have made.

The particular tax treatment contained herein is based on Harvest Financial Services Limited’s understanding of current Revenue practice as at March 2019. Please note that the tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should take such independent tax advice as you deem appropriate.

This marketing information has provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives or financial position or risk attitude or liquidity needs or capital security needs of a particular person. It should not be relied upon to make investment decisions.