Gross v Net Income Replacement in Retirement.

Tax Benefits for the Over 65s

When planning for retirement income, your net after-tax income will determine whether or not you can afford the lifestyle you would like to enjoy.

When a client reaches age 65, and later when they are eligible to receive the State Pension, a number of tax reliefs and benefits kick in:

- An additional tax credit of €245 per person – for a married couple, this is an additional €490 tax credit.

- Income tax exemption if total income (including the State Pension) is less than €18,000 pa for a single person or €36,000 pa for a married couple*. Even if the client’s income goes over this figure, there is a marginal relief on income up to double the limit, which can reduce the client’s income tax bill.

- No USC on the State Pension.

- A reduced rate of USC of 2% for the over 70s whose income, subject to USC, is less than €60,000 pa. or if full medical card holder at any age.

- No PRSI on the State Pension, private pensions and annuities. PRSI applies to ARF withdrawals, but only up to age 66 currently.

*At least one aged 65 or over

Net Income Replaced

The resulting tax savings for the over 65s can be significant.

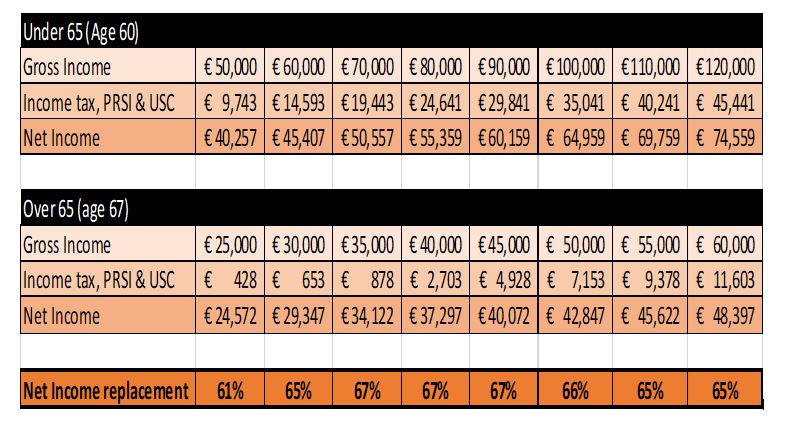

Take an example of a married couple, one income. Let’s take a target of a 50% gross income replacement in retirement. This is inclusive of the full State Pension (Contributory) at €470.80 per week, so that the balance of retirement income will come from private pensions, annuities and or ARF withdrawals*

Married couple, one income

A few surprising facts emerge

- A 50% gross income replacement in retirement is much more like 2/3rds net income replacement, when allowance is made for the various tax reliefs and benefits applying to retirees over age 65.

- The retiree in this example only starts to pay taxes when their retirement income (inclusive of the State Pension) exceeds €36,000 pa. Up to that level of retirement income, they only pay USC.

€60,000 income for a working couple under age 65 gives rise to a total tax liability of €14,593; however, a retired couple over age 65 with €60,000 income, pays taxes of €11,603 pa (€2,990 pa less than the under 65 couple with the same income

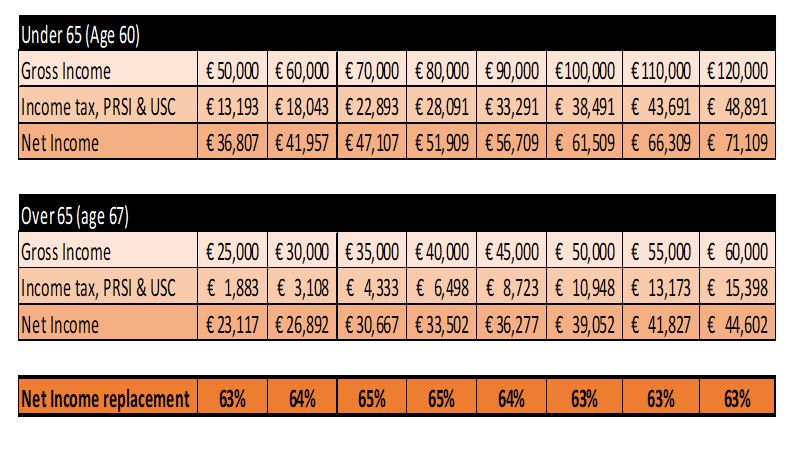

The figures for a single person are broadly similar

Conclusion

Assuming the current taxation system retains the same, retirees over 65 will benefit from a significant reduction in tax on their income.

This means that a 50% target gross income replacement in retirement will replace about 2/3rds of their net income, the difference being the tax “bounce” which the over 65s get.

Whatever your desired level of income in retirement, taking these and other factors into account within a structured plan can provide you with a level of comfort and reassurance – we are here to assist, so get in touch at justask@harvestfinancial.ie or call 01-2375500.

Capital Acquisition Tax

The marketing material is not intended to provide advice and is provided for general information purposes only. The particular tax treatment contained herein is based on Harvest Financial Services Limited’s understanding of current Revenue practice as at February 2021. Please note that the tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should take such independent tax advice as you deem appropriate.