Market Insights January 2024

Current Topics in Markets

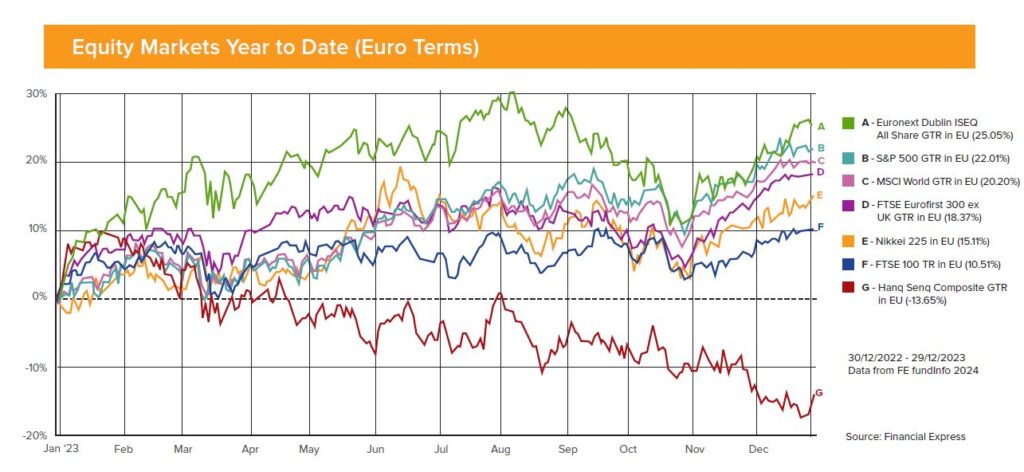

Unless you were unfortunate enough to hold substantial exposures to China or to commercial property, then 2023 was in all likelihood a good year for you in portfolio terms as virtually all regions and asset classes recorded progress over the period. And despite the fact that the world is witnessing two significant conflicts which show no signs of ending, the mood in financial markets as we look into a new year is generally one of cautious optimism. The interest rate hiking cycle has almost certainly run its course and so far there are no signs pointing to anything more than a shallow recession. The US in particular is likely to be helped by the fact that it is an election year although given the nature of this particular election that is by no means a certainty.

Economies in Europe look somewhat more fragile and recession risks are undoubtedly higher. This could of course mean that the ECB and BOE will start to reduce interest rates sooner than the US, possibly as early as the Summer. Markets, particularly bond markets, should respond positively to this prospect.

Trade tensions between the US and China continue to simmer away and any worsening of this situation will not be good news for the global economy. With an election ongoing in Taiwan, there is clear potential for a flashpoint over the coming weeks and months.

On balance however, we do not feel it is a time to dial down investment risk excessively as there is clear value in many asset classes. Our expectation is for a year of growth in financial markets in 2024, no doubt peppered by plenty of bouts of volatility.

Equity Markets

Once again, China was alone among the major equity markets in having a negative performance period in December. The Chinese economy continues to falter driven by high corporate debt levels and weak consumer demand. While it is certainly not a one way bet, China looks cheaper currently than it has for a very long time. There are also ample value opportunities elsewhere – small and midcap companies on both sides of the Atlantic look cheap although recovery will depend on economies being supportive. The Japanese market had a very positive performance in 2023, driven by an improving economic backdrop and Government measures designed to improve corporate profitability – despite the positive outturn for the year, there is still a good value case to be made for this market too going forward.

Bonds

The increase in interest rates may well still lead to a spike in default rates in high yield bonds, particularly those rated single B or below. Elsewhere however, the value argument for bonds seems irrefutable. Yields on investment grade and sovereign bonds are at a level currently that buyers are being paid a very decent return in terms of income while they wait for capital values to recover in response to falling interest rates. In our view, all investment portfolios should be carrying a material exposure to bonds currently given the returns available.

Property

While the outlook for offices and high street retail remains quite uncertain, other subsectors of the property market including residential, healthcare and logistics offer good long term income, often index-linked, and the prospect of long term growth. Should interest rates remain around current levels, highly geared property structures could face challenges so such structures are to be avoided. Many REITs however, carry low levels of debt and currently trade at significant discounts to their asset values. We expect recovery to be slow however because of the strength of the negative market sentiment around property as an asset class.

Alternatives

Despite a more positive outlook for risk assets generally, the equity market may well deliver plenty of volatility over the coming year. Because of this we continue to advise clients to include alternative asset classes (infrastructure, renewable energy, private equity etc) in their portfolios whether for reasons of low volatility or stable income.

Our Fund in Focus for January 2024 is JPMorgan Global Emerging Markets Income Trust

As always, you should only consider the investment views contained in this Market Insights update in the context of your own attitude to risk and how such choices might impact your Asset Allocation model. Should you wish to discuss your investment portfolio, please contact Harvest Financial Services on 01 2375500 or email justask@harvestfinancial.ie.

Navigating Redundancy in the Tech Sector

This marketing information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and/or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Warning: The return may increase or decrease as a result of currency fluctuations.

Warning: The figures refer to the past. Past performance is not a reliable indicator of future results.

Warning: The value of your investment may go down as well as up. You may get back less than you invest.

Warning: The income you get from this investment may go down as well as up.