Property Investment using your Pension – Higher Returns

Property Investment using your Pension –

Are Higher Returns on Direct Property Ownership More Apparent than Real?

Internationally, property is usually classified as an alternative asset class i.e. alternative to the mainstream asset classes which generally include equities, bonds and cash. However, interest in property as an investment is well above the norm in Ireland to the extent that it is viewed as a core asset class by many investors.

Property can be sub divided into commercial property (offices, shops etc) and residential property.

Commercial property is largely beyond the reach of individual pensions because of the large lot sizes involved but pension investors do have plenty of choice in gaining indirect exposure. For Irish commercial, options include unlisted funds such as IPUT, SSGA Windwise and the various insurance company funds and stock market listed entities such as Hibernia REIT and Green REIT. While all of these options are comparable, there are material differences between them in terms of costs, liquidity, underlying exposures and distribution policies. As a result, it is strongly recommended that investors receive professional advice before deciding which option best suits them.

For many individual pension investors, residential property has significant attractions. This has become heightened with the recovery in the residential market in Ireland over recent years. While the option of buying direct property into your pension fund may appear attractive, it does bring with it many significant drawbacks (see below). The alternative is to acquire indirect exposure to Irish residential property by way of listed vehicles such as IRES REIT, Cairn Homes and Glenveagh or unlisted structures such as Landholm. Again, there are material differences between each of these options and professional advice is an essential input in helping to decide on the most suitable vehicle.

Apart from the feeling of owning real bricks and mortar and lower costs (commonly more apparent than real), direct purchase of property by a pension fund brings the following disadvantages which should be seriously considered before opting for this route.

- Portfolio Risk

Having a major part of your pension fund tied up in a single asset is a very high risk strategy and flies in the face of good portfolio management.

- Management Challenges

Property ownership invariably brings management headaches whether they are management charges, tenant issues, property maintenance, repairs, void periods etc. all of which carry a real cost.

- Low Net Yield

A common complaint one hears from property owners is that while they are receiving a good headline rent much of it is being eaten up by running costs to the extent that their net yield from the property is disappointingly low.

- Poor Liquidity

Property is a highly illiquid asset and it can take a significant length of time to convert a property into cash. This is especially true during a period of market weakness.

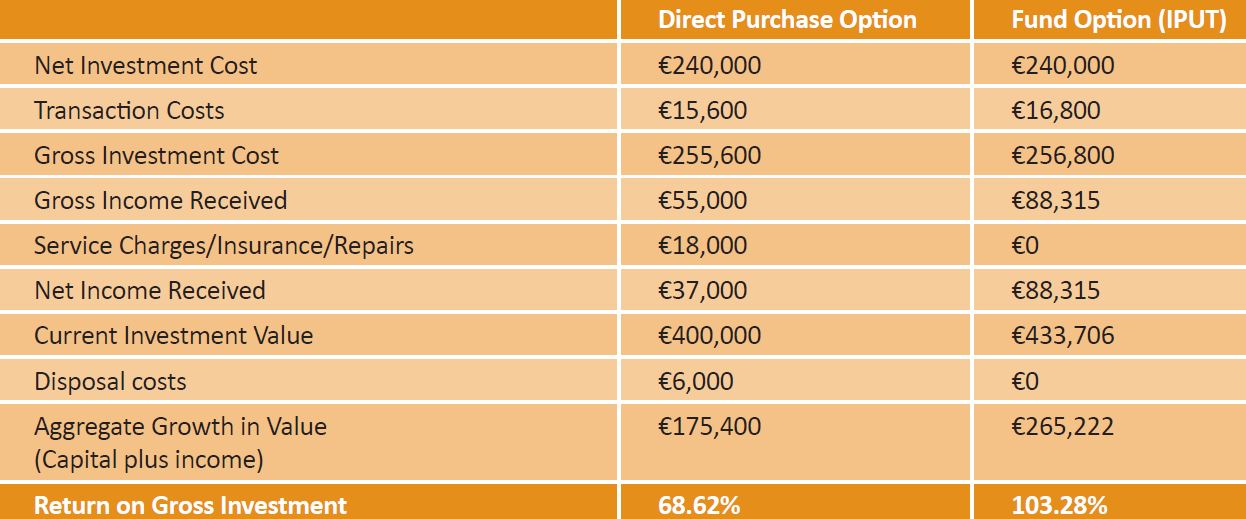

Take the example of two pension investors who wanted to invest in property in 2012. One invested directly in an apartment in Dublin 3; the second invested in IPUT (Irish Property Unit Trust).

Direct vs. Fund Purchase 2012-2017

This simple example shows that the return on a property fund can be greater than on a direct property purchase once the costs associated with the direct property are factored in.

Property is an illiquid asset and investors should only consider this asset class for medium or long term investments. If you are considering a property investment through your pension it is important to seek professional advice to look at the different options available to you to maximise your returns.

To find out more about how Property fits into your pension investment strategy call us on 01 2375500 or email justask@harvestfinancial.ie.

Investing Pension in Property

Why you should consider Property as an asset class for your Investment

Buying a Property through your Pension – General property investment rules

Harvest Liquid Property Strategy

This marketing information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and/or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Warning: Past performance is not a reliable guide to future performance.