Polar Capital Technology Trust

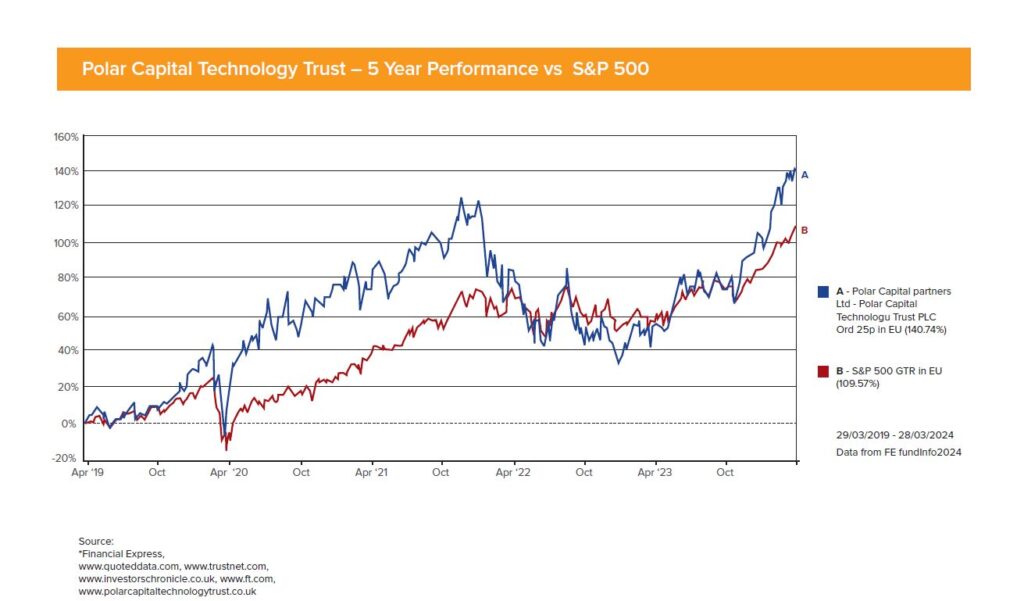

This months Fund in Focus is Polar Capital Technology Trust. The Company aims to achieve long term capital growth by investing in a diversified portfolio of technology companies. While the fund has a significant concentration in the US, it does invest on a global basis. from around the world This fund provides investors access to this enormous, fast-evolving potential. The fund, managed by a team of dedicated technology specialists, is a leading investment trust with a multi-year, multi-cycle track record – a result of the managers’ active approach and their ability to not only identify developing technology trends early on but to invest with conviction in those companies best placed to exploit them. As new major trends emerge, disrupting industries and companies across the world, Polar Capital Technology Trust is well-placed to exploit these opportunities.

Points to Note:

- Polar Capital has one of the largest dedicated technology investment teams in Europe

- The trust has taken a big bet on AI, with 80% of the portfolio invested in companies believed to be AI-enablers or beneficiaries, according to Richard Williams, an analyst at QuotedData. In fact, manager Ben Rogoff described himself as an AI-maximalist.

- It is currently trading at a 10% discount to the net asset value (NAV) of the shares held by the trust, making it an attractive way to gain exposure to this fast growing sector.

- The fund invests in very liquid companies, which allows the managers to quite easily switch the focus of the fund when market circumstances shift.

As always, you should only consider the investment views contained in this Polar Capital Technology Trust update in the context of your own attitude to risk and how such choices might impact your Asset Allocation model. Should you wish to discuss your investment portfolio, please contact Harvest Financial Services on 01 2375500 or email justask@harvestfinancial.ie.

This marketing information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and/or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Warning: The return may increase or decrease as a result of currency fluctuations.

Warning: The figures refer to the past. Past performance is not a reliable indicator of future results.

Warning: The value of your investment may go down as well as up. You may get back less than you invest.

Warning: The income you get from this investment may go down as well as up.