Published in FM Report – by Terry Devitt

In 1978, plans to build Ireland’s first nuclear plant at Carnsore Point in Wexford were met with a tidal wave of objections, including an onsite protest concert attended by 8,000 people. Prevailing fears around the dangers of nuclear power plants were subsequently compounded and exacerbated by a series of international incidents (i) an accident at Three Mile Island in Pennsylvania in 1979 (ii) ongoing reports about radioactive discharges into the Irish Sea from Sellafield in the UK (iii) the Chernobyl disaster in the Ukraine in 1986 and (iv) much more recently, the weather related disaster at Fukushima in Japan in 2011.

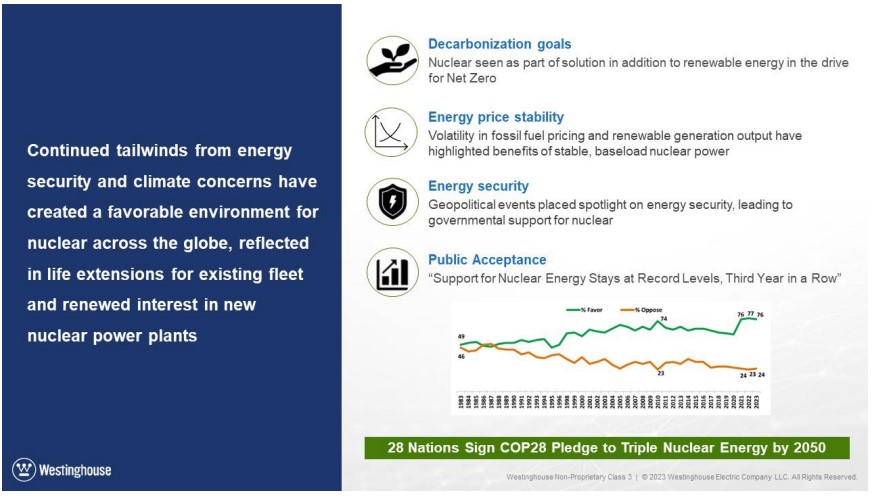

The truth today, however, is that nuclear has moved from being the bete noire of power generation to now being viewed as an essential component for the future power needs of the world. This change in attitude has been driven principally by climate change concerns. It is recognised by most informed observers that we simply cannot tackle the climate challenge without nuclear. Its complete cycle emissions levels are lower than even wind and solar and are a tiny fraction of traditional fossil fuel plants. Improvements in awareness and technology have also led to much safer construction and operating practices around nuclear plants.

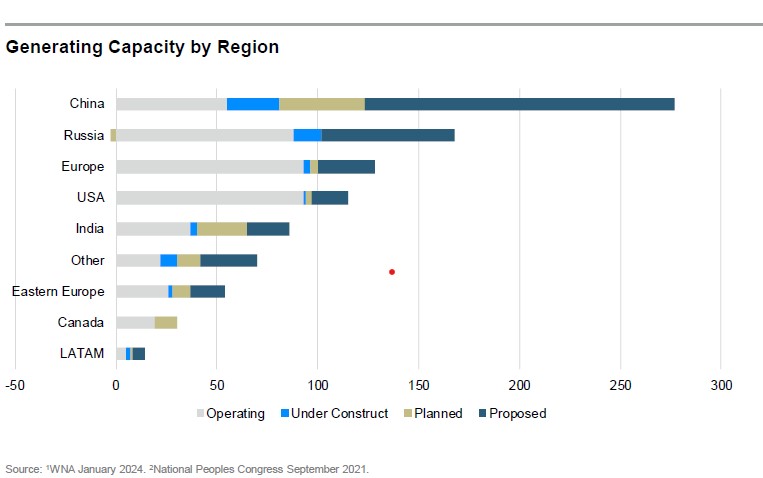

Nuclear energy currently provides around 10% of the worlds power needs – official projections suggest that this proportion will be 25% by 2050. In broad terms the industry needs to triple in size in order to achieve this target and at the recent COP28 Summit, 28 nations signed a pledge to do just that. Pro nuclear governments including China, the US, Japan and many European countries have included nuclear power in their green frameworks and have encouraged its growth through incentives. China alone has 55 operating reactors currently but has plans to build a further 154 by 2035.

A Complex Supply Chain

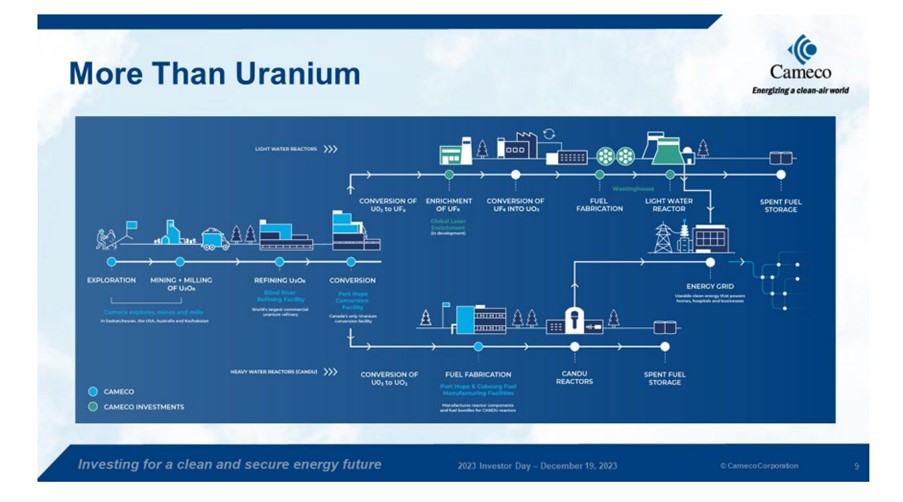

From the point of extraction from the earth to the ultimate point of useful application, most metals require some degree of processing/refining. In the case of uranium, the chain is far more complex than most, as the diagrammatic below shows. The raw material needs to go through a number of steps which include refining, conversion and enrichment before the final fuel product is available for use. The nuclear fuel supply chain begins with mining and milling the uranium ore. This is then converted into uranium hexafluoride gas and then enriched for use in reactors to produce fuel. The complexity of the chain of course means that the availability of fuel ready product is not simply down to the volume of uranium ore being mined. The availability of sufficient capacity for every step along the supply chain will determine the rate at which the market can grow.

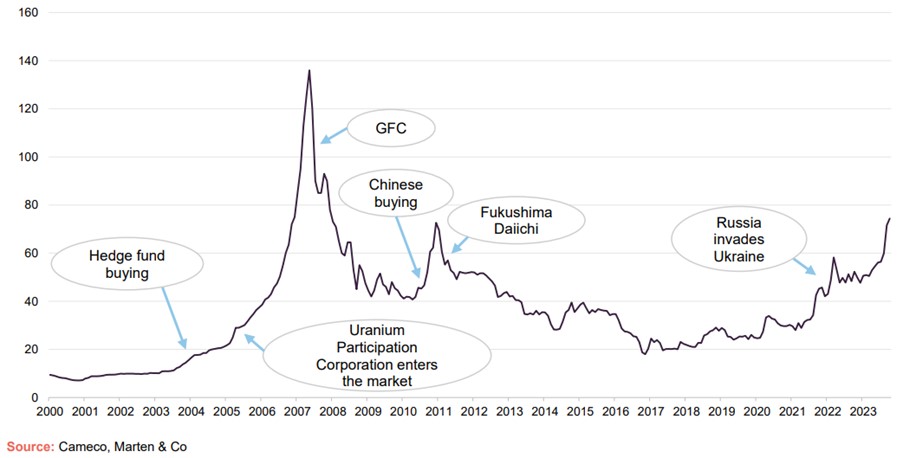

And then of course there are the geopolitical considerations. Many of the interesting uranium ore deposits are in politically sensitive locations including some of the former Soviet states and in Russia itself. The Russian invasion of Ukraine, and the sanctions that followed, in combination with a military coup in Niger (world’s seventh largest producer of uranium and source of 25% of EU supplies) led to an inevitable supply deficit. This deficit has since been met since by increased supplies from some of the more stable geographies, including the US and Canada. However, because of the projected growth in uranium use across the world the supply demand picture is expected to remain very tight for the next number of years at least. The situation is likely to be exacerbated by downstream bottlenecks in the fuel cycle, particularly at the conversion stage. The inevitable outcome of this scenario will be sustained upward pressure on the Uranium spot price.

There is little doubt that the growth case is clearcut and wherever growth opportunities arise, investors soon follow. So for investors looking to get exposure to the nuclear energy story what options do they have?

Because of its radioactive nature, added to the need for extensive processing to convert the raw mined output into a useable fuel source, uranium does not trade on the open commodity markets in the same way other metal ores do. As a result, investors do not have the option of investing directly in uranium ore and investment exposure to the metal must be effected indirectly rather than directly. This is achieved principally by investment in the companies carrying out the mining, refining and conversion, of which there are a number listed on global stock markets.

Cameco, listed on the Canadian stock market, is the world’s largest publicly traded uranium company. Cameco’s mining and exploration activities are located principally in northern Saskatchewan where it owns two of the world’s largest high grade uranium deposits at Cigar Lake and McArthur River. The company’s projected output for the next five years is fully contracted out, a situation driven by the ongoing demand/supply gap. As the chart below shows, the growth projected for the nuclear industry for years to come is clearly reflected in the company’s share price.

Cameco Share Price 2021-2024

Source: Financial Times

NexGen Energy is another listed miner/producer based in Saskatchewan and like Cameco controls extensive tracts of uranium-rich deposits. Following on from new extraction permissions and the development of same, NexGen’s output is expected to grow strongly over the coming years. Like Cameco, its share price has seen huge growth over recent years as a result of expectations building around the growth of the nuclear industry.

Apart from direct investment into uranium companies, there are also a number of listed ETFs available which give exposure across the nuclear industry. These include the Global X Uranium ETF and the Sprott Uranium Miners UCITS ETF provided by Hanetf. Both of these ETFs offer an exposure to a range of companies operating in the nuclear sector, thereby giving a highly diversified way of investing in the uranium play.

In addition to the above, there is an investment trust listed on the London Stock Exchange, called Geiger Counter, which is a specialist nuclear industry investment vehicle, also investing in nuclear related companies across the globe. Geiger may well offer a couple of advantages over the passive ETFs. Firstly an active manager may be a better choice because of the specialised nature of the industry and secondly this trust is currently trading at a discount of almost 20% to the market value of the shares held within the trust.

The nuclear industry has been receiving a growing amount of attention from the investment world in recent times and this has been reflected in strong growth in company valuations across the sector. However, there are very good reasons (not least the huge expansion plans of many countries across the world) to believe that we are at the very early stages of a long run bull cycle when it comes to the uranium price in particular and the nuclear industry in general.

Author: Terry Devitt, Head of Investments at Harvest Financial Services first published in the FM Report.

The information in the above article has been provided for discussion purposes only. It is not advice, it is provided for general information purposes only and does not fully take into account an investor’s financial position, investment needs and objectives, attitude to risk, liquidity needs, capital security needs, capacity for loss, or ESG preferences. If you invest in these products, you may lose some or all of the money you invest. Past performance is not a reliable indicator of future results.

Warning: Past performance is not a reliable guide to future performance.