Market Insights October

‘The “Super-7” US stocks [Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla and Meta] now make up more of the global equity index (MSCI ACWI) than the whole stock markets of Japan, the UK, China and France combined’.

Schroders September 2023

While the bigger topics of interest rates and inflation have continued to dominate financial markets, there is no doubt that the issue of valuations, particularly of the big US tech companies, has come to the fore more and more in recent months and has been a significant factor influencing the direction of equity markets. Apple and Amazon are down by more than 8% over the past month while Nvidia has fallen by more than 9%. Because of their sheer size, further weakness in these stocks will have a material influence on equity markets over the near term, and not just in the US.

The growing likelihood that interest rates will stay high for longer than might have been thought previously, is also driving investors to focus more on value and valuations and to put increasing emphasis on company cash flows, bottom line growth potential and dividends in evaluating investment opportunities. We may not be quite at the valuation extremes experienced during the dotcom boom (although we are not far away) it does feel like we may be at a similar inflexion point. In the years following the dotcom crash investors made excellent returns from boring traditional companies with strong balance sheets and good cash flows. Clients might be well advised to again switch their focus in that direction.

Having taken something of a backseat following the outbreak of war in the Ukraine, ESG is now very much back to centre stage as an investment theme. Particular sub-themes within ESG, notably decarbonisation and energy transition, are garnering a lot of attention due to the sheer urgency attached to bringing the rise in global temperatures under control. We have recently added one such fund to our Recommended List for clients and this is covered in our Fund in Focus section below.

Equity Markets

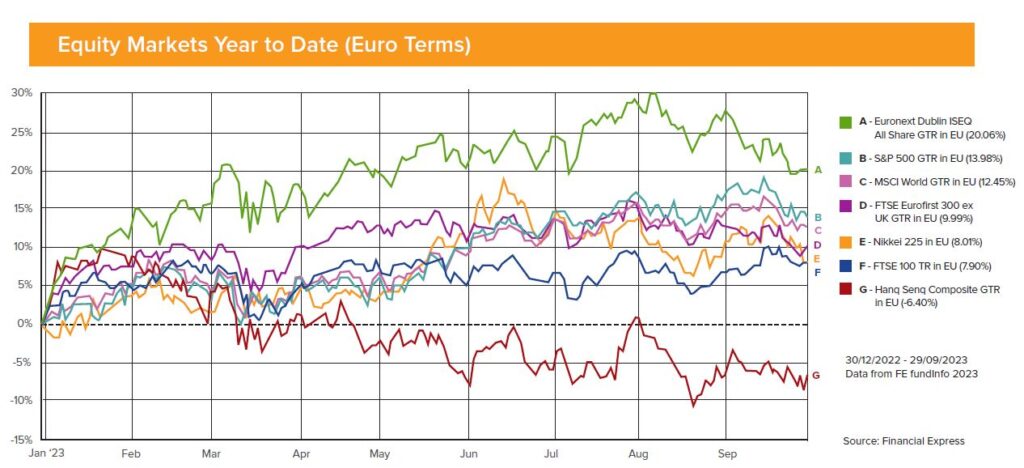

All major equity markets trended negatively in September with the exceptions of the UK and China which were marginally up in euro terms (possibly on the basis that they were already exceptionally cheap). And there would seem to be no reason to expect much variation from this weakening trend for the remainder of the year. However, the economic picture in the US suggests that, with earnings holding up and inflation falling slowly, a recession may be avoided. As a result, we are becoming more optimistic about the prospects for 2024. As mentioned, we continue to emphasise funds with little or no exposure to big tech but with a focus on the value end of the equity spectrum.

Against this backdrop emerging markets, which already looked relatively cheap, could offer real opportunities. In that context, we favour Latin America over China and within Asia we continue to favour India and smaller markets such as Vietnam, all of whom are benefiting from China’s current woes. Mexico looks particularly interesting as China’s post covid losses on the international trade front become Mexico’s gains due to America’s desire to near-shore its supplies of key materials and finished products.

Equity Market Performances (percentage change in euro terms)

| Market | Performance Sept 2023* | Performance 1 year* | YTD* |

| Ireland | -5.45 | +35.31 | +20.06 |

| UK | +0.75 | +16.00 | +7.90 |

| Japan | -2.71 | +10.24 | +8.01 |

| Europe | -2.28 | +21.05 | +9.99 |

| US | -2.97 | +12.53 | +13.98 |

| China | +0.19 | +0.52 | -6.40 |

*Source: Financial Times, Financial Express

Bonds

Ongoing concerns about interest rates staying high for longer have led to further weakness in bond markets during September. However, we remain convinced that bond markets now offer a very attractive risk reward ratio to investors together with annual yields in excess of 5%, well above bank deposit rates. We prefer the high to mid grade parts of the bond spectrum where the default risks remain extremely low. In a rising rates environment the possibility of defaults rising among smaller more indebted bond issuers is a real one and as a result we recommend avoiding this end of the bond market.

Property

Possibly the least favoured asset class for some time now and with good reason. Rising interest rates have traditionally been bad news for property valuations because of the levels of indebtedness associated with property ownership. Combine that with the post covid impact on the demand for offices and with the ESG fuelled demand for greener and more sustainable buildings and it all adds up to a highly challenging environment for property. Furthermore, income seeking investors have been understandably switching away from property and into bonds where income/risk balance is seen as more appealing. For patient investors however, there are plenty of pockets of the property market where demand remains high, tenant default risk is low and income levels are very attractive.

Alternatives

Many sectors within the Alternatives space have also been victims of the switch by investors into bonds paying attractive levels of income. Infrastructure and renewable energy specialist funds in particular have suffered. As a result, many such funds have moved to trading at relatively large discounts to the value of their underlying assets and to paying shareholders high levels of annual dividends. Moreover, in contrast to bonds, these asset classes can offer the prospect of real growth over the medium term. We continue to favour adding such funds to client portfolios.

Our Fund in Focus for October is Osmosis Resource Efficient Core Equity Strategy

As always, you should only consider the investment views contained in this Market Insights update in the context of your own attitude to risk and how such choices might impact your Asset Allocation model. Should you wish to discuss your investment portfolio, please contact Harvest Financial Services on 01 2375500 or email justask@harvestfinancial.ie.

This marketing information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and/or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Warning: The return may increase or decrease as a result of currency fluctuations.

Warning: The figures refer to the past. Past performance is not a reliable indicator of future results.

Warning: The value of your investment may go down as well as up. You may get back less than

you invest.

Warning: The income you get from this investment may go down as well as up.