Is There Value in China?

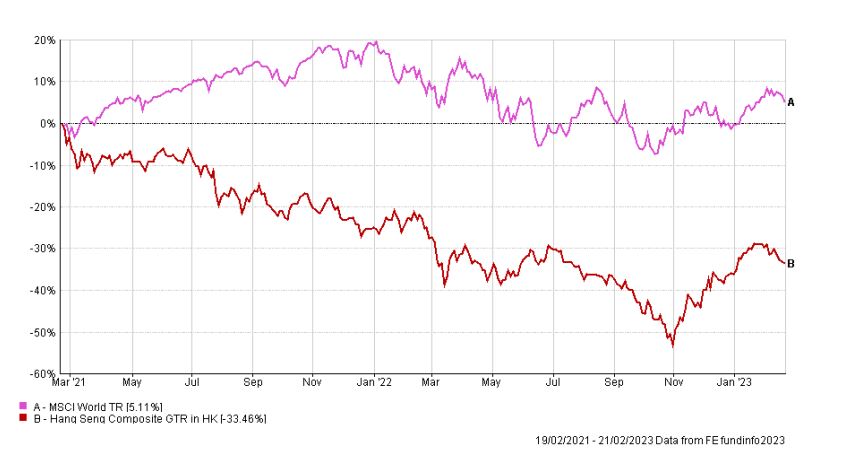

Covid was not a good time to hold Chinese equities. The zero covid policy implemented by government, and the associated lockdowns, significantly curtailed economic activity thereby bringing many years of strong growth to a halt. Inevitably this was reflected in equity markets and, over the past two years, Chinese equities significantly underperformed world markets.

As China began to ease its covid restrictions in Q4 of last year, the market responded and has performed quite strongly since then. Investors took the view that both industrial output and Chinese consumer spend were likely to respond rapidly and the reopening of the economy was a significant buying opportunity. However, share prices are still well below their recent historical norms and relatively speaking, still look to offer decent value. Generally speaking 2023 is likely to deliver plenty of volatility to equity markets and Chinese markets will not be immune. The big risk for China of course is a political one. The US China relationship has certainly been better than it is currently and China’s refusal to relinquish its claim on Taiwan remains a slow-burning fuse. Counter to that, the past two decades has seen the emergence of a citizenry with greater expectations and much less tolerance of events which would disrupt the more comfortable lives they have become used to. On balance, and on a longer term view, the Chinese market represents a good buying opportunity right now and has a place in all investment portfolios.

For more information, or to arrange a meeting to discuss the suitability of investing, please contact us on 01 2375500 or email justask@harvestfinacial.ie.

This marketing information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and/or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Warning: The return may increase or decrease as a result of currency fluctuations.

Warning: The figures refer to the past. Past performance is not a reliable indicator of future results.

Warning: The value of your investment may go down as well as up. You may get back less than

you invest.

Warning: The income you get from this investment may go down as well as up.