In Ireland, women receive pensions that are 26.1 per cent lower than men’s, according to a European Commission report* from 2018.

The report considered total income from all sources, including State, occupational, and private pensions. For those on modest incomes, the report found the pensions’ gender gap in Ireland was lower than other European countries, largely because the State pension has been successful in providing a gender-balanced basic level of income.

But, for those on higher incomes, the report indicates women’s pensions are almost 45 per cent lower than men’s, compared to an EU average gap of 37.2 percent for the pensioners aged 65-79 in the EU-28.

Women need to prepare better for retirement and in particular need to be aware of their pension position, and their entitlements, long before retirement age.

Build a Better Pension

There are two main ways that women can help secure better pensions in retirement.

Firstly, where circumstances permit, they should work longer. This will help secure the maximum contributory State pension of approximately €12,700 a year. This is a valuable asset, roughly equivalent to a private pension pot of over €300,000, according to the Department of Social Protection.

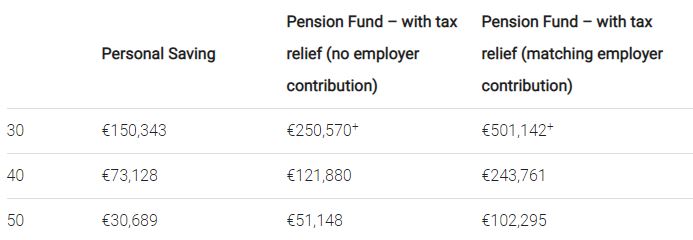

Secondly, women should also contribute to a private pension, where possible. A 30-year-old woman could accumulate a pension pot of more than €250,000+, over 35 years, for the price of a latte a day (€3.50). If her employer can contribute at the same level, the pot can rise to more than €500,000+.

For young women looking at job options, the offer of an employer pension contribution may not be so relevant to their living standards today; but pension provision is a very attractive benefit that will make a huge difference when they are no longer working.

So, for the cost of that coffee a day in private pension savings, combined with an employer contribution, and the contributory State pension, women can accumulate a pension pot of more than €800,000, equivalent to a pension income of €32,000 a year.

The State Pension

It is important to understand that there are two kinds of State pension, a means-tested one, paid only to people in very modest circumstances, and a contributory pension that is paid to people who have worked. This is based on the number of PRSI contributions made while in employment, and is not means-tested.

The Department of Social Protection’s Homemakers Scheme makes qualifying for the contributory State pension easier for those who take time out of the workforce for caring duties.

The scheme, which applies more regularly to women, allows up to 20 years spent caring for children under 12 years of age, or incapacitated adults, to be considered when the person’s social insurance record is being averaged for pension purposes.

While beneficial for women, and men, who have taken time out of the workforce; they still need to work for certain specified periods, and to make a certain number of PRSI contributions, to secure the full contributory pension (See panel below on qualifying for the Contributory State Pension).

Why the Gap in Women’s Pensions?

Women’s participation in the labour market, and supplementary private pension coverage, has improved recently, although female participation in the labour force in 2018 still amounted to only 55.5 per cent, compared with 68.6 per cent for men (Source: CSO QNHS, Eurostat LFS).

The pensions gap may be partly explained by the gender difference in full-time and part-time workers; as full-time workers in Ireland are enrolled in private pension plans more often than part-time workers are. Data from the Quarterly National Household Survey (QNHS) shows that women tend to be more often in part-time jobs than men.

In addition to lower levels of private pensions, there are also gaps in levels of income derived from occupational pensions. When it comes to retirement, women are 67% more likely than men to invest in a defensive fund with a low expected level of growth, contributing further to the gender pension gap^. This shows that women need to closely look at their pension coverage, and the adequacy of the retirement income they will derive, long before retirement day comes.

Recent changes mean that people who are under the age of 58 today won’t receive their State pension until aged 68. So, even though people may have to retire at 65, this makes the need to bridge the gap with a private provision even more important.

Of course, not all women are in a position to work, due to caring duties or the cost of childcare. Women relying on their husband’s pension need to make sure they understand the pension, and what they can expect from it. It is also important for women to ensure that any pension assets accumulated during a marriage are fairly divided between spouses, in cases of separation or divorce.

Everyone, women in particular, is encouraged to put some advance planning into how they will be provided for on retirement. People may have company pension plans they have stopped contributing to, since leaving work, or be unsure as to what their State pension entitlements may be.

Pension Planning Tips for Women

- Start your pension today! However little you can afford to save, the sooner you start saving, the more you will have in your retirement.

- If you see yourself as a pension saver rather than a pension investor, make sure that your fund is invested in lower-risk assets that you are comfortable with.

- Secure your contributory State pension by working as long as necessary.

- If you are married and relying on your husband’s pension in retirement, make sure you understand the pension, and what you can expect from it.

- If you are separated, get your own advice in relation to splitting the pension under a pension adjustment order.

Are you entitled to a full contributory State pension?

In order to get the full contributory State pension*, individuals have to:

- Begin insurable employment at least 10 years before pension age.

- Have a minimum of 520 qualifying contributions (10 years contributions).This includes contributions to class A and class S. Only 260 contributions can be made up of voluntary contributions.

- Achieve a yearly average of at least 10 qualifying contributions, paid or credited, over your working life, which is deemed to be up to the end of the tax year before you reach pension age.

- Have a yearly average contribution of 48 or over, from the time of entry into employment, to get the maximum contributory pension.

The conditions around getting a Contributory State Pension are complex, so the advice is that anyone who has ever worked and paid contributions, at any time, should apply. There are a number of ‘pro-rata’ pensions available, at different levels, for people who have paid different types of social insurance contributions, or who did not pay contributions because of various reasons, such as caring for children.

Author: Emer Kirk is a pension consultant with Harvest Financial Services Limited, a chartered tax advisor and a Certified Financial Planner. She is a specialist in women’s pension provision and is co-founder of the Connect Women in Pensions Network.

*The legislative information contained herein is based on Harvest Financial Services Limited’s understanding of current practice as at March 2019 and may change in the future.

The material is not intended to provide advice and is provided for general information purposes only.

Harvest Financial Services Limited is regulated by the Central Bank of Ireland

* The 2018 Pension Adequacy Report: current and future income adequacy in old age in the EU

^Research carried out on behalf of Aviva, 2017

A woman aged 30 giving up her daily latte and saving the cost (€3.50) until age 65 will have accumulated a fund of €150,3431. Add to this the generous tax relief available for pension contributions and she will have a fund of €250,5702. Where her employer matches her contribution to the pension, the fund size is €501,142 at age 65.

1 Assumes that the savings are invested and provide a compounded annual return of 6% p.a. over the term.

2 Assumes tax relief at 40%; rate of return of 6% p.a. over the term

Article by Emer Kirk – Published in The FM Report

The marketing material is not intended to provide advice and is provided for general information purposes only.

The information contained herein is based on Harvest Financial Services Limited’s understanding of current Revenue practice as at April 2019 and may be subject to change in the future.

The legislative information contained herein is based on Harvest Financial Services Limited’s understanding of current practice as at April 2019 and may change in the future.