Pensions from Prior Employments

On leaving an employment you will have a decision to make as to how best to manage the pension benefits you accumulated during your time there.

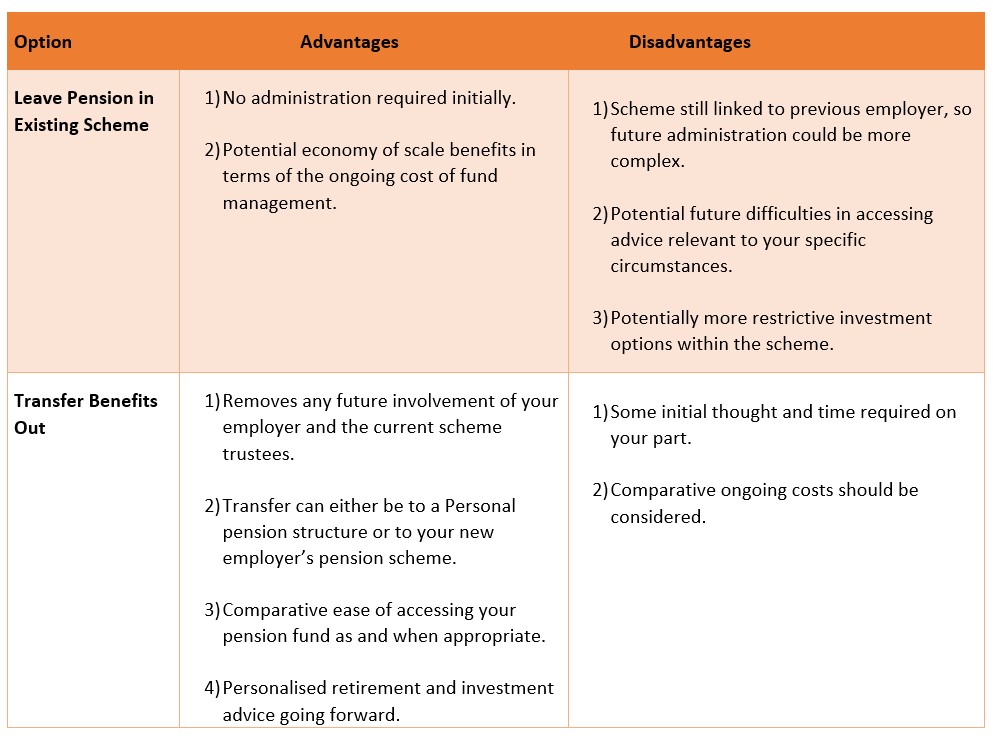

At the risk of over-simplification, the decision will usually revolve around whether you leave your benefits in your previous employer’s pension scheme; or transfer the pension fund out of the scheme into another type of pension structure.

The below table illustrates some of the relevant considerations when making this decision.

Personal Retirement Bonds

A Personal Retirement Bond (PRB) is one structure into which you might elect to transfer your pension fund. A PRB is a pension plan in your own name, available to access any time from age 50 once you have left that employment.

A Personal Retirement Bond:

- Gives you more control of your pension assets,

- Removes any future connection with your old employer,

- and allows you to invest your pension fund in line with your individual circumstances and financial objectives.

Who can set up a Personal Retirement Bond?

- Anyone leaving or already left an employment with a pension fund relating to that employment.

- Anyone leaving their occupational pension scheme.

- Anyone whose company pension scheme is being wound up

Why Chose Harvest as your PRB Provider?

- We provide competitive and transparent charging structures.

- We will recommend an investment portfolio designed around your needs and long term objectives.

- We will give you a clear picture of the expected retirement income from your pension.

- We offer simple and transparent advice.

- Harvest is an established advisory firm with a team of experienced retirement and investment planning professionals.

- We are a multi-award winning advisory firm, including Pension Broker of the Year in 2015, 2016, 2017, 2018 and 2021 at the Irish Pensions Awards.

What PRB Options are Available with Harvest?

There are three types of PRB, each one with different features that should be considered in the context of your Retirement Plan.

1) A Harvest Advisory PRB

- An Advisory PRB offers access to a global universe of Funds and Investment Trusts managed by some of the best Investment Managers in the world.

- There are more options as to where your PRB fund can be invested, included Alternative Assets, Investment Trusts and income generating investments.

- Again, the portfolio will be well diversified and appropriate to your investment risk tolerance.

2) A Harvest Self-Administered PRB

- A Self-Administered PRB offers you the highest level of flexibility and control over your pension fund.

- A Self-Administered PRB typically offers a much wider range of investment options. You can invest in Property, Funds, Shares and Bank Deposits.

- A Self-Administered PRB is suitable for clients with pension funds in excess of €500,000.

3) A PRB offered by one of the Life Companies in Ireland

- An insured PRB allows you to select from a range of pre-constructed investment options with less need for you to have an input into your investment portfolio.

- The portfolio will be well diversified and appropriate to your investment risk tolerance.

- The portfolios are typically rebalanced quarterly to ensure they stay within the specified risk level.

Retirement Planning Expertise and Innovation

Your pension fund will form a key role in your wealth management and financial planning objectives.

We will be happy to advise you as to what structures best meet your needs. Each option has comparative advantages and disadvantages, and we will explain these clearly so that you are comfortable with the recommendation.

To find out more about PRBs, and for a clear picture of what retirement income your pension might provide you with, contact Harvest at justask@harvestfinancial.ie or on 01 2375500.

Find out more about a Personal Retirement Bond

Pensions and Redundancy

Please note that the provision of this product or service does not require licensing, authorisation, or registration with the Central Bank of Ireland and, as a result, it is not covered by the Central Bank’s requirements designed to protect consumers or by a statutory compensation scheme.

Warning: If you invest in this product you will not have access to your money until your retirement date.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in this product you may lose some or all of the money you invest.

This material is not intended to provide advice and is provided for general information purposes only.