Wealth Management

Retirement Planning Specialist – Pension Broker/Financial Advisor of the Year 2021

Wealth Management

At Harvest we offer wealth management advice to individuals, charities, corporate partnerships and businesses, which is specifically designed around their individual circumstances.

Your Harvest advisor will take the time to get to know you and your requirements, offering sound and trustworthy financial advice that adapts as your needs change over time.

When it comes to the provision of investment advice we do not believe in complicating matters. We want our clients to see us as their trusted advisor in all aspects of their financial affairs.

Your best interests remain our priority. Getting to know you and your needs is the first step of our process.

By using plain language, we aim to keep communications simple and concise to make sure that you clearly understand our proposals and recommendations. Our focus is on transparency and keeping you meaningfully informed throughout.

By working closely with you and establishing your attitude to risk and reward, based on an assessment and analysis of the information you provide, your Harvest advisor will propose an asset allocation to meet your wealth management needs and objectives.

What level of risk are you comfortable with?

Every investor’s needs and circumstances are different. Your Harvest advisor’s ability to provide you with advice suitable to your circumstances is dependent on our knowledge of your financial position, investment needs and objectives, attitude to risk, liquidity, importance of capital security, etc.

Our advice seeks to optimise the investment returns in your portfolio through identifying a suite of investments from our list of recommended funds reflecting your personal circumstances and preferences.

We always consider the long term picture and understand that strategic investment advice relies on timing and patience allied to insight and market intelligence.

Whether you are investing your pension, corporate, personal or charity funds we take the same approach to ensure you have an overall investment portfolio that meets your investment needs and objectives.

Appropriate advice delivering you long term results

The basics of investing never changes – it always come down to risk and reward. At Harvest we want to tilt the balance of risk and reward in your favour through appropriate advice and strategic thinking.

No matter what stage in life you are at, our team of seasoned professional advisors will tailor an asset allocation for your portfolio that optimises investment returns by seeking the highest possible return for the level of risk you are willing to take.

Your Harvest advisor’s experience and insight will guide you through the maze of investment options from our continuously updated list of recommended funds.

Key features of our Investment Advisory service

• Our advisor will help you understand your risk profile and will identify your investment objectives with you.

• Our advisor works closely with you in identifying investment solutions tailored to your unique needs and goals.

• You will be notified of new market opportunities and gain access to quality investment ideas.

• Our advisor will periodically review your investments with you in the context of market developments, your investment plan and any notified changes to your investment objectives.

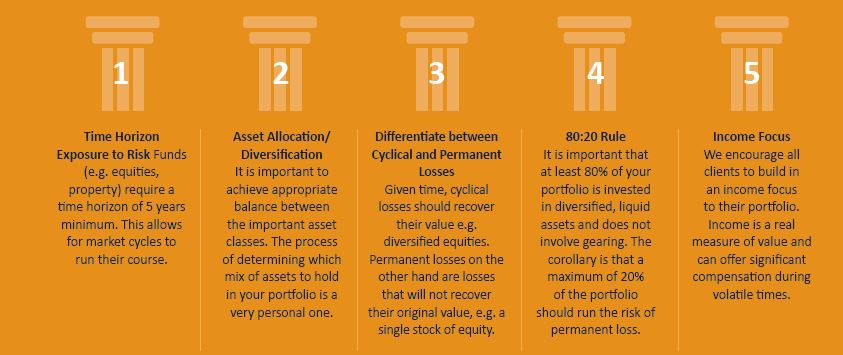

If your investment objective is to achieve fund growth over the medium to long term our advisor will consider our 5 Investment Pillars before advising you.

Appropriate advice delivering you long term results

The basics of investing never changes – it always comes down to risk and reward. At Harvest we want to tilt the balance of risk and reward in your favour through appropriate advice and strategic thinking.

No matter what stage in life you are at, our team of seasoned professional advisors will tailor an asset allocation for your portfolio that optimises investment returns by seeking the highest possible return for the level of risk that you are willing to take. Our advisor’s experience and insight will guide you through the maze of investment options from our continuously updating list of recommended funds.

Harvest Investment Strategies

This marketing information has been provided for discussion purposes only. It is not advice, it is provided for general information purposes only and does not fully take into account your financial position, investment needs and objectives, attitude to risk, liquidity needs, capital security needs, capacity for loss, etc. It should therefore not be relied upon to make investment decisions. Prior to any formal investments taking place you will be provided with a detailed suitability letter taking into account all the above and outlining why the investment(s) are (not) suitable for you.

Warning: Past performance is not a reliable indicator of future performance.