Investments

Pension Broker/Financial Advisor of the Year 2021

Every investor’s needs and circumstances are different. Getting to know our clients is the first step of our process. Our advisor’s ability to provide advice suitable to our client’s circumstances is dependent on our knowledge of their financial position, investment needs and objectives, attitude to risk, liquidity needs, importance of capital security, capacity for loss etc.

We are conservative in our investment approach and believe strongly in our clients diversifying their investments across all important asset classes. Balancing risk and reward is very important when planning for your financial future. We work closely with you to see where you are now and where you want to be in the short, medium and long-term.

Our Investment Department is core to ensuring an unbiased view of product providers and their funds that are considered for inclusion on our list of recommended funds. They undertake a stringent due diligence process before a fund can be added to our list, which includes face to face meetings with the fund managers and a detailed analysis of historic performance.

Our Investment Advisory Service provides you with active guidance through the process of idea evaluation, identification of the right solutions for your unique profile and implementation of your investment plan.

Key features of our Investment Advisory Service

- Our advisor will help you understand your risk profile and will identify your investment objectives with you.

- Our advisor works closely with you in identifying investment solutions tailored to your unique needs and goals.

- You will be notified of new market opportunities and gain access to quality investment ideas.

- Our advisor will periodically review your investments with you in the context of market developments, your investment plan and any notified changes to your investment objectives.

If your investment objective is to achieve fund growth over the medium to long term our advisor will consider our 5 Investment Pillars before advising you.

A dedicated Harvest consultant will be appointed to handle your portfolio and to deal with any queries you may have. Once your portfolio is up and running, you will receive an update on a regular basis, and you will be encouraged to keep the consultation process going by way of regular contact with your consultant. We operate on a transparent charging basis, with all costs affecting your investment being fully disclosed before you invest. Harvest is a fee based adviser.

On our first meeting with you, we undertake a rigorous analysis of your needs and objectives, taking account of:

- Your attitude to risk

- Your expected investment term

- Your income requirements

- Your liquidity requirements

- The disposition of your current assets

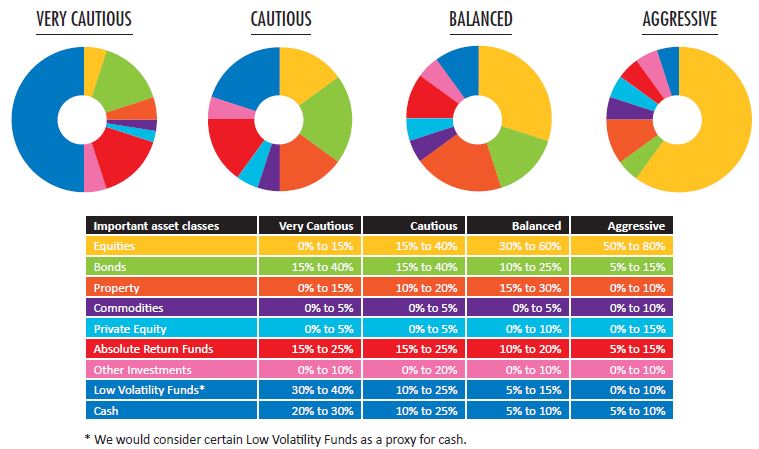

Asset allocation

Deciding on what proportion of your portfolio is invested in each of the asset classes is known as asset allocation and is a critical element of portfolio building. The recommended ranges for the four primary risk categories of investor are:

IMPORTANT ASSET CLASSES

We have decades of in-house investment expertise and a thorough understanding of the important asset classes which can be summarised as follows:

Equities:

Equities refers to shares of companies which are quoted on a stock exchange. This asset class will represent the single most important asset class for most investors. While equity markets move in unpredictable cycles and can go through highly volatile phases, they have consistently delivered strong returns to investors over the long term. We recommend investors seek exposure to equities via pooled structures rather than direct shares;

Bonds:

Bonds are issued by governments, public sector bodies and companies and the vast bulk are essentially loans offering fixed rates of interest and predetermined maturity dates. While bonds have traditionally been viewed as low risk, this is not necessarily the case and the level of risk is down to the financial strength of the issuer. As with equities, we favour pooled structures over direct bond purchases;

Property:

Property is an important asset class which has delivered very attractive returns to investors over the longer term. There is a very wide range of options available to investors seeking exposure to property but investors should be aware of the additional risks associated with liquidity and gearing in relation to this asset class;

Commodities:

The term commodities refers to a wide range of items from oil to base metals (iron ore, copper, zinc, etc.) to food materials (wheat, soya, pork bellies, etc.). Commodity prices can be very volatile and as a result can be high risk for investors not familiar with the underlying markets;

Private Equity:

Private equity refers to investment in companies not listed on a stock exchange. Unlisted shares and funds are generally seen as high risk due to poor liquidity and the commercial uncertainties associated with smaller businesses;

Absolute Return Funds:

Absolute return refers to returns that are independent of the direction of the underlying markets in which the funds are investing. Through exposure to the right funds, investors can achieve a more stable lower risk return than might be achieved via the more traditional asset classes;

Other Investments:

This is a catch-all title which includes investments like precious metals (gold, silver, platinum, etc.), currencies, renewable energy, forestry as well as lower risk options such as structured products. Each of these alternative asset classes will have particular characteristics which should be carefully appraised prior to investing; and

Cash:

For liquidity purposes, as well as for risk management reasons, cash will always form a part of any investment portfolio. Cash is currently generating a very low return, certain highly liquid low volatility funds can be used as a cash proxy for a proportion of the portfolio which might more usually be allocated to cash.

Self Administered Pension Scheme – SAS

Approved Retirement Fund – ARF

To find out how our investment advice can help you achieve financial freedom in retirement contact us at justask@harvestfinancial.ie or on 01 2375500.

This marketing information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and/or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Warning: Past performance is not a reliable guide to future performance.