Risk to Income in Retirement

After you have made adequate provision for your essential income needs, you may want to ask yourself another question with the aim of meeting your additional requirements: Can I afford to take risk with some of my post retirement fund to aim for better returns?

Risk to Income in Retirement?

If you have been investing for a number of years you may be familiar with the idea that ‘risk’ represents the chance your investments could fall in value. In general, higher risk investments have a higher potential return, whereas lower risk investments usually give a lower return. This still applies in retirement, but we in Harvest believe a bigger risk is the risk that the capital in your ARF runs out too soon.

The risk that capital in your ARF runs out too soon is affected by three key factors:

-

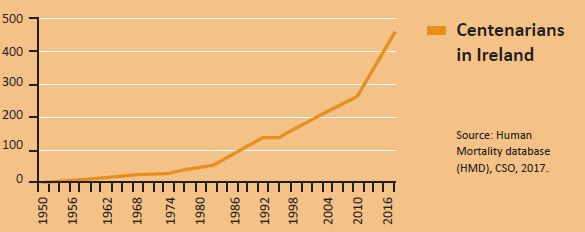

Longevity

Rising life expectancies are undoubtedly good news. However, they are putting significant strain on both the State and on pension pots. Average life expectancy has increased significantly over the last 100 years, with men expected to live until age 83* and women expected to live until age 86*. When you are planning your retirement income, it is essential to consider carefully the risk of outliving the money you set aside for retirement. Have a look at the increase in the number of centenarians in Ireland over the last 60 years!

-

Inflation

As prices rise over time, the real value of the money you set aside for retirement can be eroded. When you are working, your income generally gets inflation protection through your annual pay rise. When you retire, inflation becomes much more of a risk if your income is not rising. This is why you may wish to invest some of your retirement fund with the aim of growing your capital and, therefore, your income.

If you had €1,000 in May 2002 you would require €1,224 to purchase the same volume of consumer goods and services in May 2017 (increase in line with the consumer price index)

-

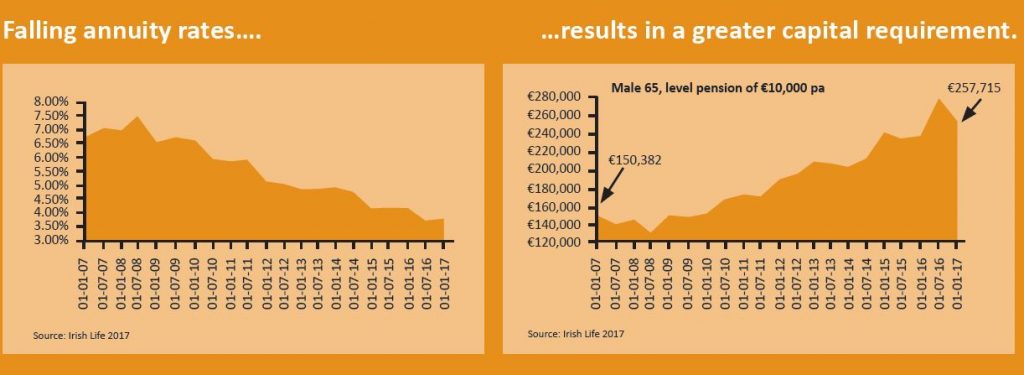

Income

We all want to have the finances for a carefree retirement, but this is becoming increasingly hard to achieve. In recent years, pensioners have faced persistently low interest rates and declining returns on assets traditionally used for retirement income, such as German government bonds. The yields on German government bonds are a key influence on annuity rates and, as the following chart shows, they have fallen dramatically. This is why you may wish to invest some of your retirement fund with the aim of paying an income and, therefore, protecting the level of your capital.

In the last 10 years the capital required for every €10,000 pension has increased by €100,000

Investing for income

In recent years, cash in the bank has generally paid very little, so drawing an income from savings alone may not allow you to maintain the lifestyle you expect. As a result, you may want to put some of your cash to work in asset classes (particularly when taking inflation into account) with the aim of generating a better level of income. Our Investment Committee have a particular focus on income producing assets when compiling our list of recommended funds from Irish and international fund managers which your Harvest advisor will use when recommending the most suitable fund(s) for your ARF.

Risk and reward

While there are varying levels of income available across the different asset classes, assets that pay higher levels of income may also have a higher risk of capital loss. Before you choose a particular income strategy, you need to be comfortable with the level of risk involved. Once your Harvest advisor has determined your investment needs and objectives, the level of income you require, when you need it, the frequency of the payments and, of course, your appetite for risk your Harvest advisor will propose an asset allocation for your ARF’s investment portfolio with the aim of achieving your specific investment needs and objectives, liquidity needs, etc. You can then take advantage of the diverse opportunities on offer.

Investment options available

Some clients wish to invest in traditional managed funds while others like to have more control over their investment options. At Harvest we discuss the advantages and disadvantages on both insured ARF structures and self administered ARF structures with our clients and then advise on the most suitable ARF structure.

Our **self administered ARF permits clients to invest in a broad range of asset classes including:

- property – either direct property or through investment funds and partnerships;

- personalised equity portfolios (funds, ETFs, investment trusts and direct share purchase);

- corporate and government bonds;

- international funds;

- private equity; and

- deposits.

Your Harvest advisor will work with you to construct an investment portfolio for your ARF to suit your stated objectives and with the aim of achieving your specific investment needs and objectives, liquidity needs, etc. Further detail about our approach to investing is available in our Investment Advisory Service page and in the Harvest Cash Alternative Strategy page.

Annual Review

Life is about change. As you move through the stages of life your needs and objectives will change. We believe that growing a long term relationship with you is a key element for a successful outcome for your ARF. At your annual review meeting your Harvest advisor will review your ARF’s investment portfolio to ensure that it continues to meet your needs and objectives, etc. and your Harvest advisor will recommend any adjustments which are considered necessary.

What is your next step?

There is no easy answer or ‘one-size-fits-all’ solution, so it is important to understand all the options. Each option has its pros and cons. You do not have to choose just one option and you may find that a ‘mix and match’ approach is the most appropriate for your situation. Your Harvest advisor will guide you through the options, considerations and challenges ahead so you can understand the choices you need to make at the point of retirement and throughout the years ahead.

Contact us on 01 2375500 or at justask@harvestfinancial.ie to arrange an initial meeting with one of our advisors. At this meeting we will seek to find out what your needs and objectives are in retirement and we will set out how we would work together to secure the lifestyle you wish to enjoy in retirement.

** Please note the provision of our product and Qualifying Fund Manager service do not require licensing, authorisation, or registration with the Central Bank of Ireland, and, as a result, are not covered by the Central Bank’s requirements designed to protect consumers or by a statutory compensation scheme.

Warnings: If you purchase an annuity you will not have any access to the money you set aside for retirement. If you set up and ARF you may lose some or all the money you set aside for retirement. Income may fluctuate in accordance with market conditions and taxation arrangements. Past performance is not a reliable guide to future performance.

The material is not intended to provide advice and is provided for general information purposes only. It should not be relied on to make decisions on retirement options.

The legislative information contained herein is based on Harvest Financial Services Limited’s understanding of current practice as at July 2017 and my change in the future.